B2B2C opportunity

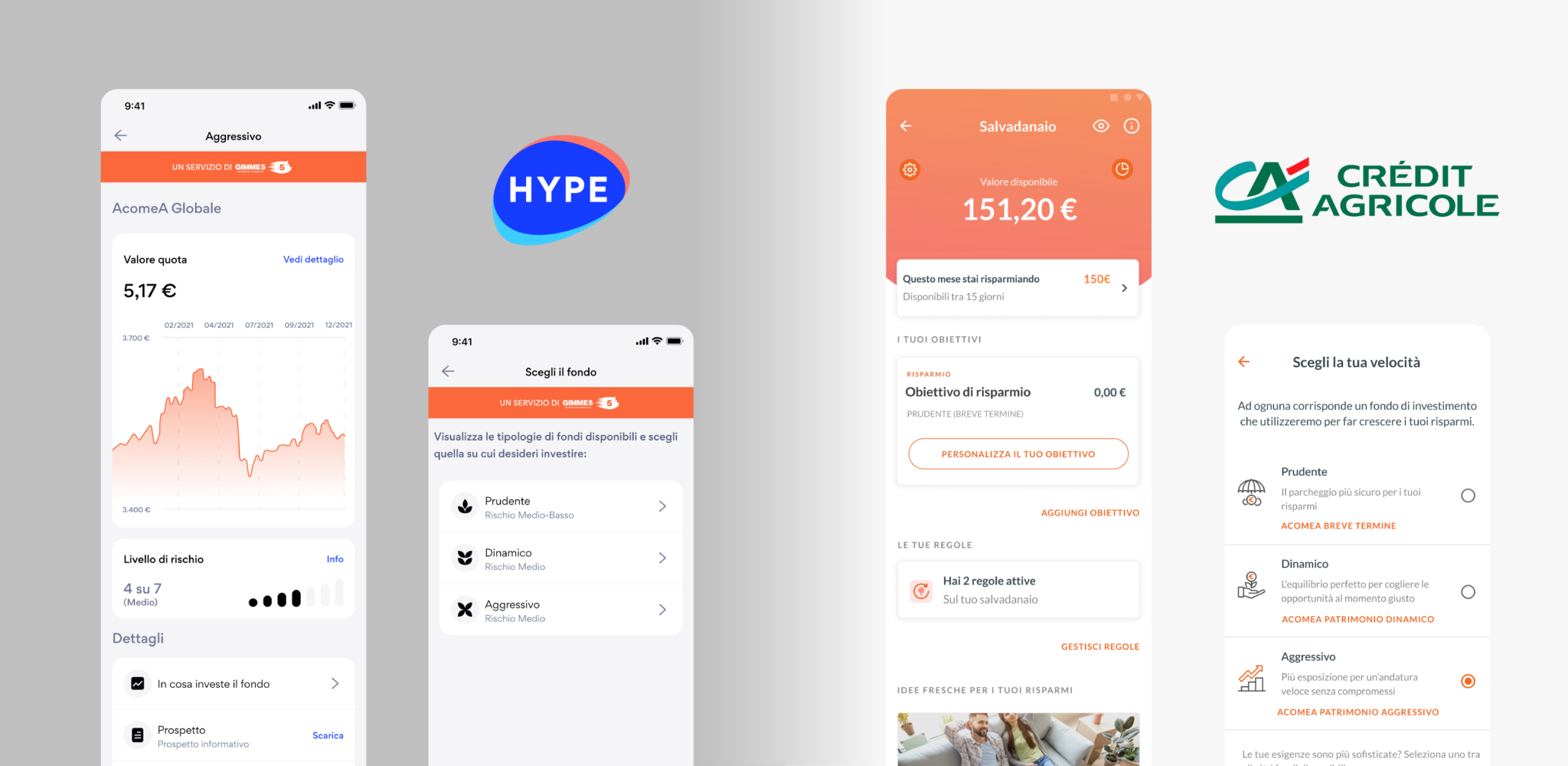

The collaborative partnership between Credic Agricole and Hype, integrated with Gimme5, facilitates the introduction of a new financial product into their bank platform.

Role

UX designer

Collaborators

Flavio Talarico

Fabio Arlati

Credit Agricole Team

Hype Team

Skills

Product thinking

Prototype

Visual design

Tools

Figma

Adobe Creative Suite

Gimme5 Opportunity

Gimme5 is actively pursuing a broader client base to engage with its investment funds. Leveraging the existing customer base of banks offers a cost-efficient avenue, given the potentially lower acquisition costs per customer compared to direct outreach efforts.

Opportunity Hype and Credit Agricole

Hype and Credit Agricole (banks) are directing efforts towards revitalizing their high-value customer segments. This strategic focus is driven by the recognition that many customers maintain funds in their accounts without active usage, leading to diminished profitability for the banks.

Goal

• Define Gimme5’s Onboarding and Usability into theri apps.

• Create a User-Centered Interface Utilizing Hype e Credit Agricole Design System.

• Driving client acquisition for Gimme5’s Investment Funds.

Success metrics

• Onboarding success rate

• Clients using Gimme5’s Investment funds on Hype and Credict Agricole

The Process

The integration of Gimme5 into each platform involved a tailored approach, considering the unique requirements of both Credit Agricole and Hype. These varied from product display preferences to specific features like investment rules and goals. Additionally, differences in customer data handling, including privacy settings and personal information, necessitated customization within the Onboarding and internal application sections. Establishing clear boundaries allowed for collaborative development of the UX flow alongside Credit Agricole and Hype, utilizing diverse collaboration and testing tools. The final UI implementation was overseen by our team, ensuring alignment with design standards and user experience goals.

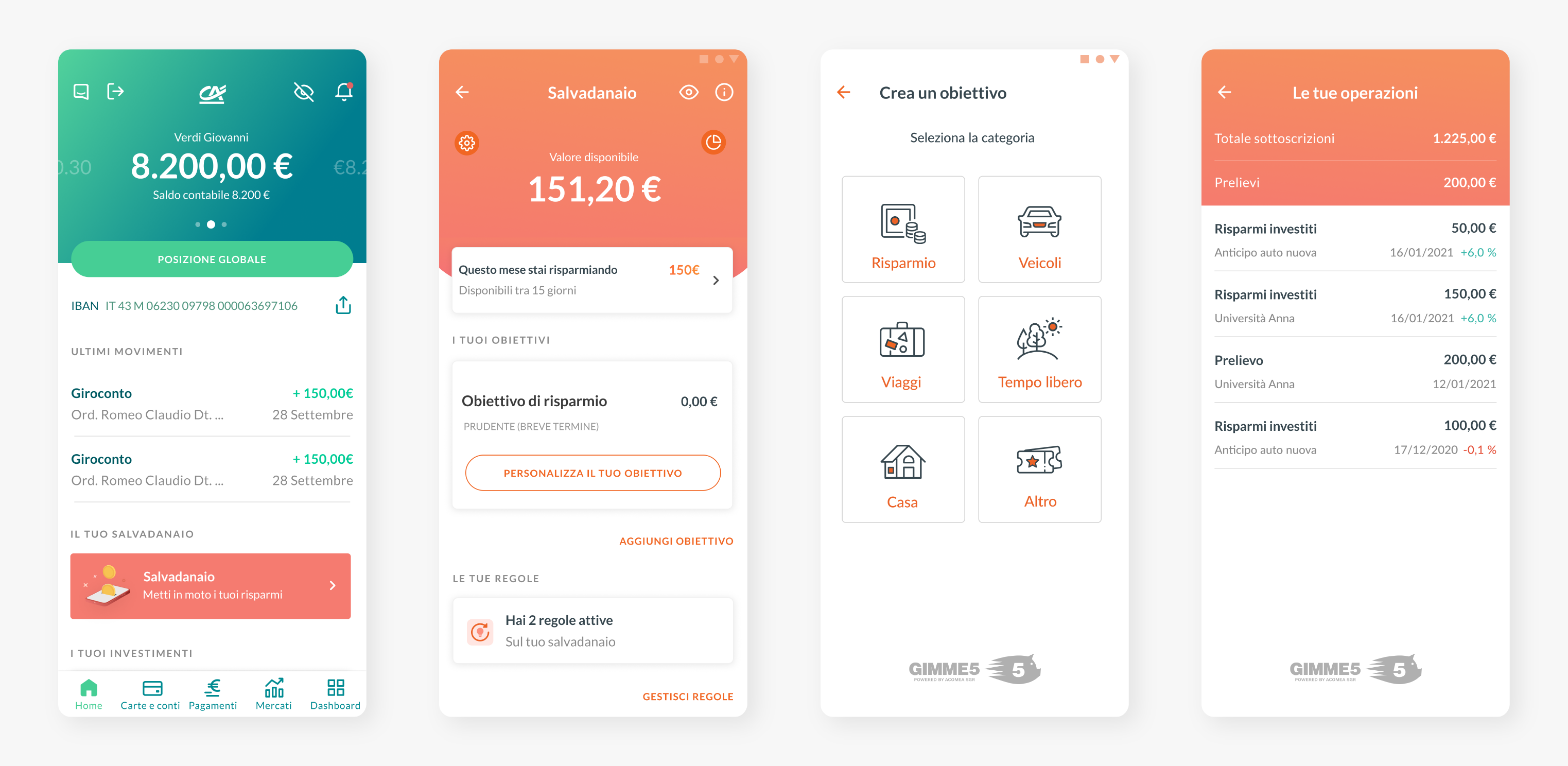

The solution for Credit Agricole

Onboarding

Drawing upon the existing data within Credit Agricole enabled the proposal of a streamlined user flow, enhancing the experience for its clients. By minimizing steps and leveraging a familiar UI, users can navigate with ease and efficiency, resulting in a smoother interaction process.

Inside the app

Credit Agricole opted to align their UX closely with our established standards, emphasizing savings and investment goals. Additionally, they chose to incorporate basic investment rules initially and to progressively reveal more advanced options through iterative disclosure. Moreover, they integrated several of our UI components into their final design process.

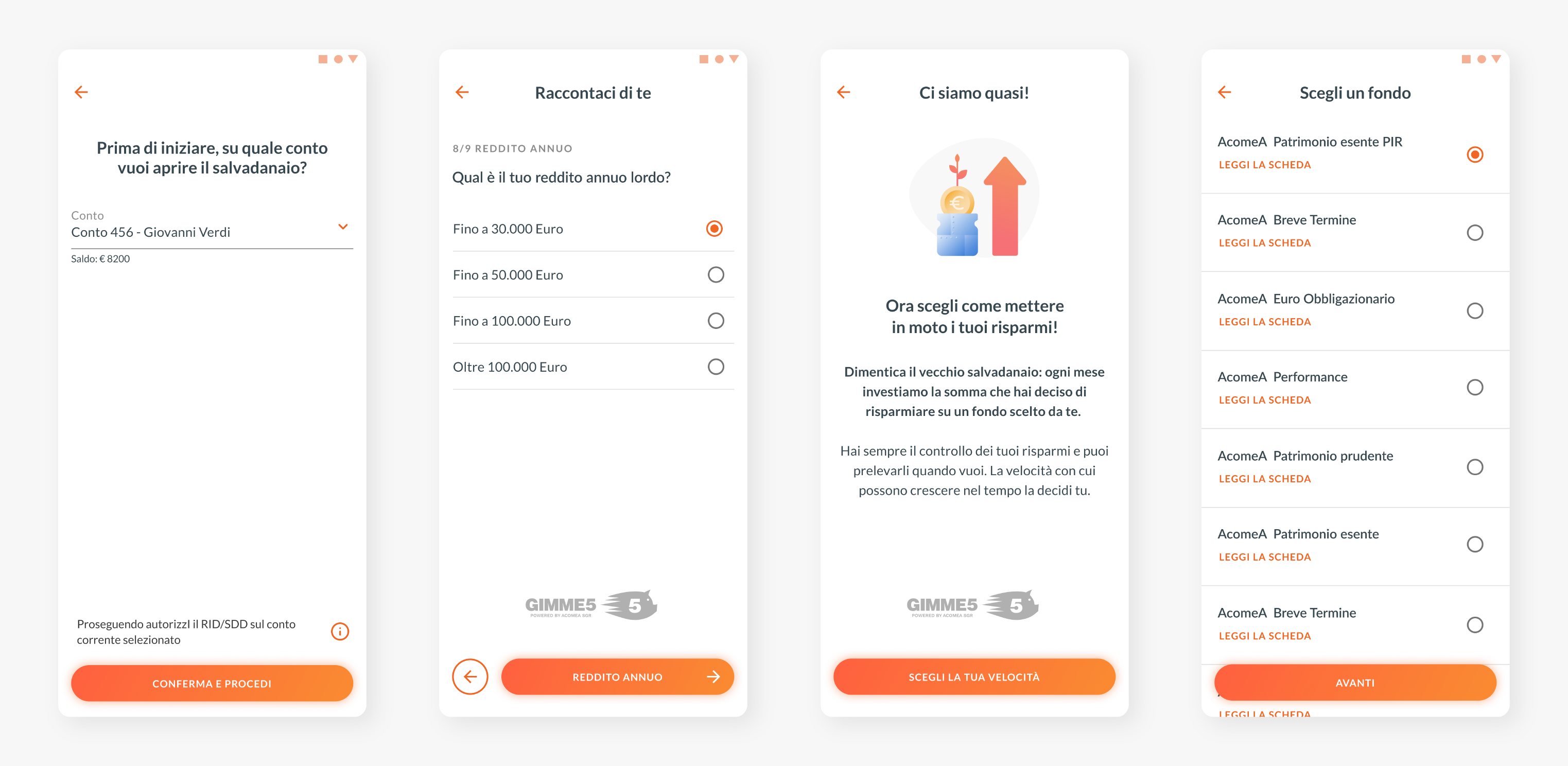

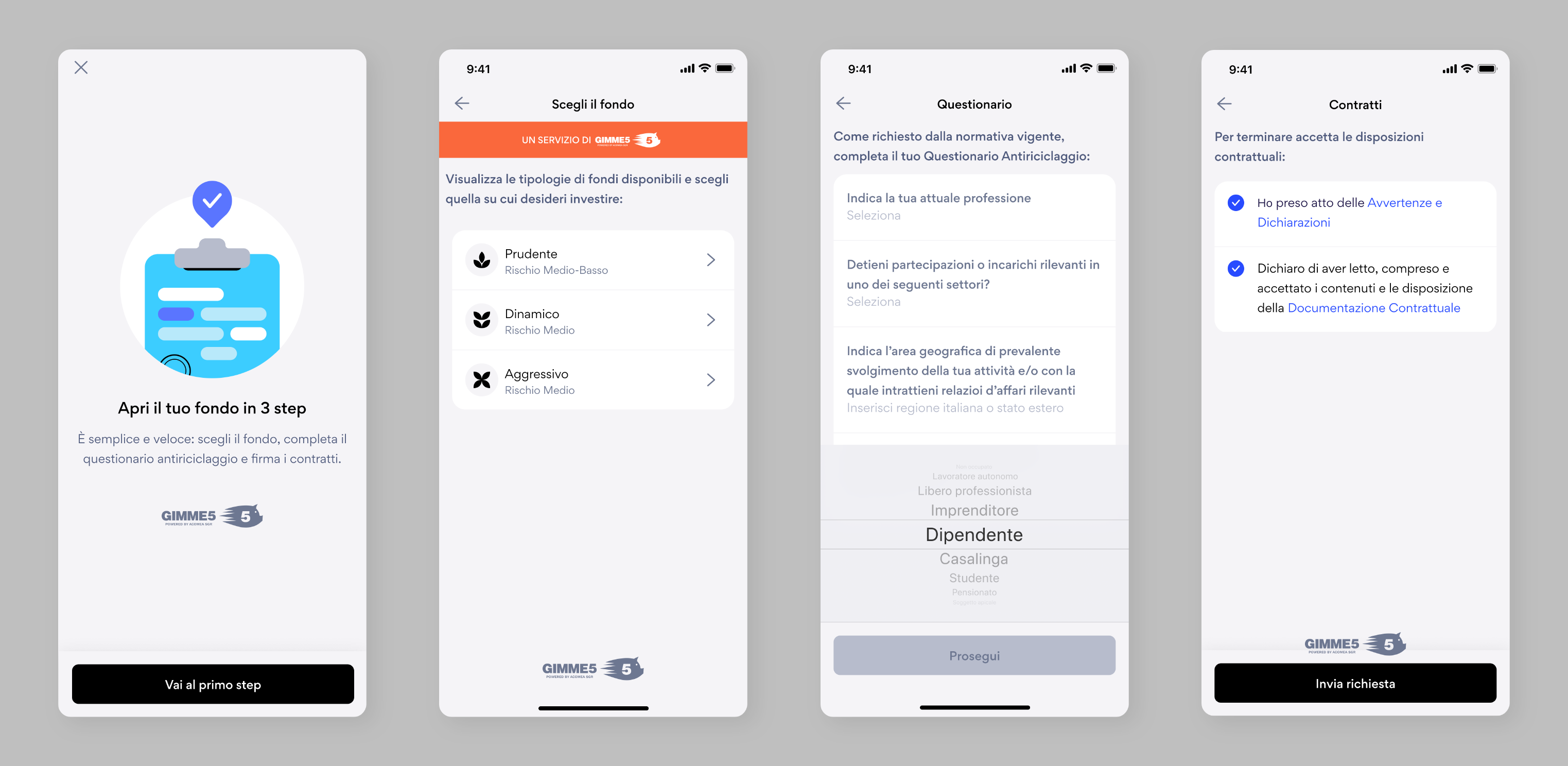

The solution for Hype

Onboarding

As Hype already offered various financial products on its platform, the implementation of the onboarding process for Gimme5 was executed with clarity and precision. Moreover, with a considerable user base already in place, the onboarding flow was crafted to be welcoming and intuitive, ensuring a seamless experience for those intrigued by Gimme5’s investment funds.

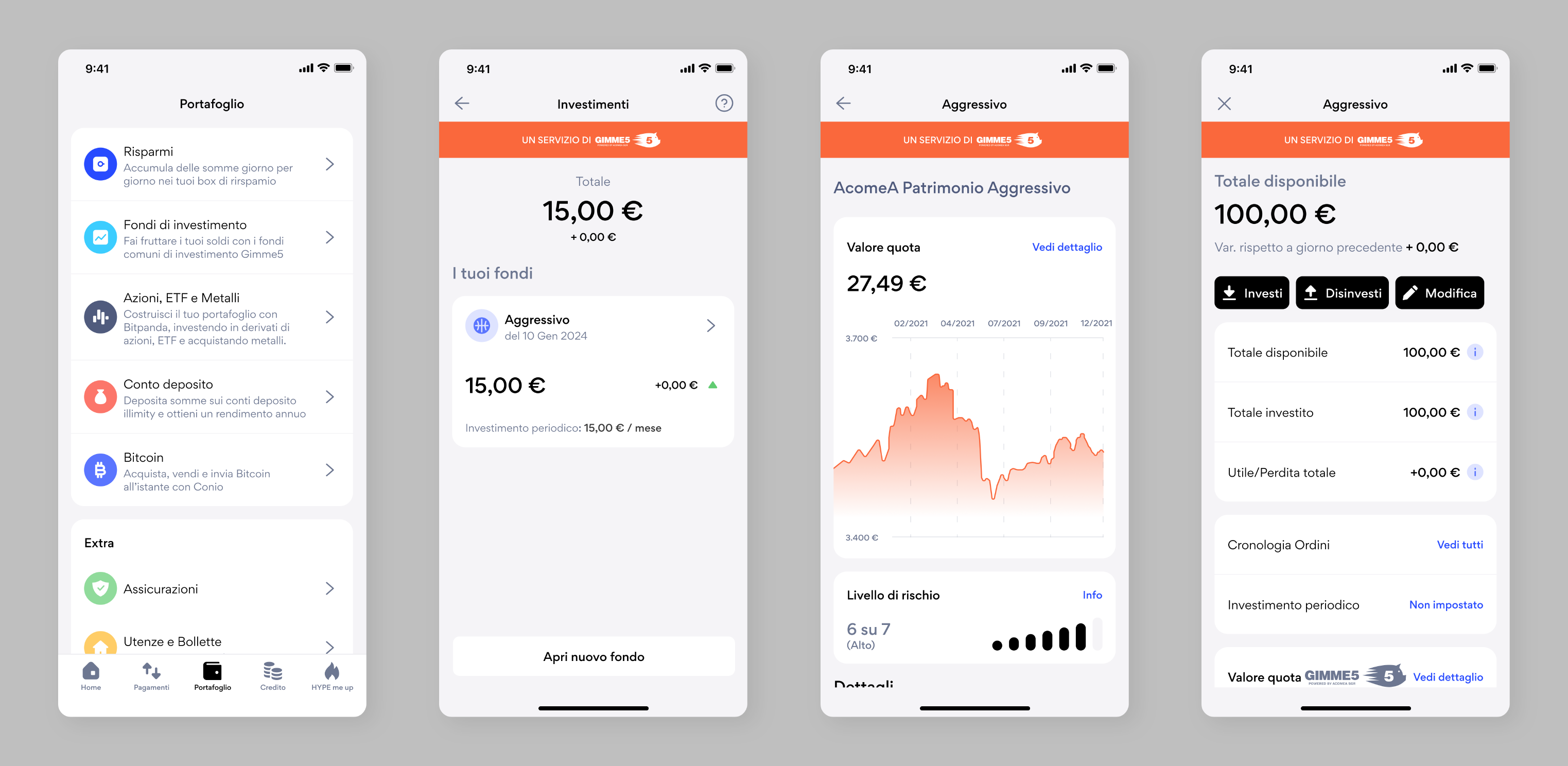

Inside the app

Given the enhanced UX and UI development expertise within Hype’s team, it was determined to incorporate elements from its current app into the development of Gimme5 inside Hype’s app. Throughout this integration, a priority was placed on ensuring transparency within the user journey, consistently emphasizing that Gimme5 stood as a separate product entity distinct from Hype’s offerings.

The results

Onboarding

• More than 39.000 clients of Hype finished the onboaring process of Gimme5

• More than 6.600 clients of Credit Agricole finished the onboaring process of Gimme5

Inside the app

• More than 28.000 clients of Hype are using the investment funds of Gimme5

• More than 4.000 clients of Credit Agricole are using the investment funds of Gimme5

Marketing assets

Collaborating with the marketing team, we partnered with an external agency to create compelling videos to offer our B2B2C service.

Example of a video that explains our technical offerings to the fintechs.

Example of a emotional video that shows our strenghts and capabilities to our possible partners.

Lets get in touch

If you want to know more don’t hesitate to shoot me a message on LinkedIn.